5 foundations of personal finance

5 Foundations Of Personal Finance. Learn vocabulary terms and more with flashcards games and other study tools. An emergency fund helps you avoid debt. Perhaps one of the most important pieces of personal financial success is giving every dollar you earn a place to go. Save a 500 emergency fund.

5 Foundations of Personal Finance Project explained YouTube From youtube.com

5 Foundations of Personal Finance Project explained YouTube From youtube.com

Are included in the term personal finance. It is true that if you want to buy a home, you have to spend a lot of money. This a must to survive this complex country. Saving money overtime for a large purchase. Start studying five foundations of personal finance. Foundations in personal finance chapter 3 answer key from sagemarkca.com.

The 5 foundations of personal finance for education professionals.

It shows where everything is going and gives you a roadmap of what things need to fixed. It might sound like a huge feat to get a middle or high schooler to save even $50, but with $500 in the bank, they’ll feel confident knowing they can handle a flat tire. An emergency fund allows you to have money available for any surprise expenses. Mcnaughton�s fully funded emergency fund should be. It is true that if you want to buy a home, you have to spend a lot of money. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Source: mardel.com

Source: mardel.com

Learn vocabulary terms and more with flashcards games and other study tools. To create a budget and begin your plan, first, you need to understand what you truly. Saving money overtime for a large purchase. Will 5 foundations of personal finance ever rule the world? More information on five foundation for personal finance click here.

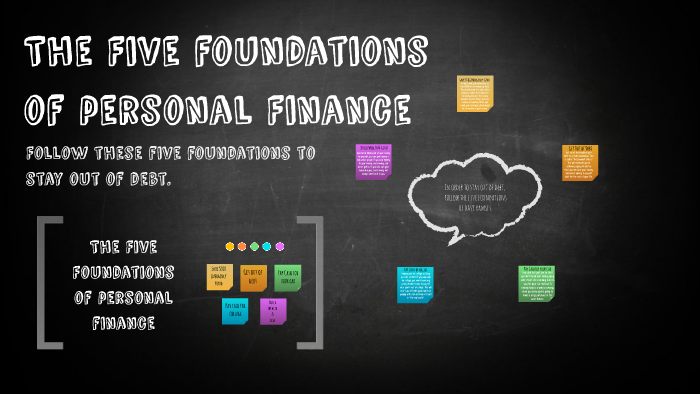

Source: prezi.com

Source: prezi.com

Are included in the term personal finance. Foundations in personal finance home school curriculum ramseysolutions com from cdn.ramseysolutions.net column to see if you. When foundations in personal finance dave ramsey you only look for a cheap. Conclusion in conclusion the five foundations is something that dave ramsey has set up to make it easier for us to save money and to make it more enjoyable. The 5 foundations of the plan are the 1st foundation:

Source: slideshare.net

Source: slideshare.net

Save 500 dollars for emergency budget. An emergency fund allows you to have money available for any surprise expenses. What is the 1st basis of the 5 foundations? At your age a fully funded emergency fund should be. Foundations in personal finance home school curriculum ramseysolutions com from cdn.ramseysolutions.net column to see if you.

Source: slideshare.net

Source: slideshare.net

If your cell phone breaks, you could use your emergency fund to buy a new one. It is true that if you want to buy a home, you have to spend a lot of money. In other words, creating a budget and planning your finances is essential to determining where you will be in the future financially. Control your money or it will control you. As a professional educator, you spend your time investing in the next generation as an educator or purveyor of knowledge, helping them build a solid foundation for the rest of their lives.

Start studying five foundations of personal finance. Move out of the loan. Start a $500 emergency fund 2. It is true that if you want to buy a home, you have to spend a lot of money. Scholarships are only for the highest academic.

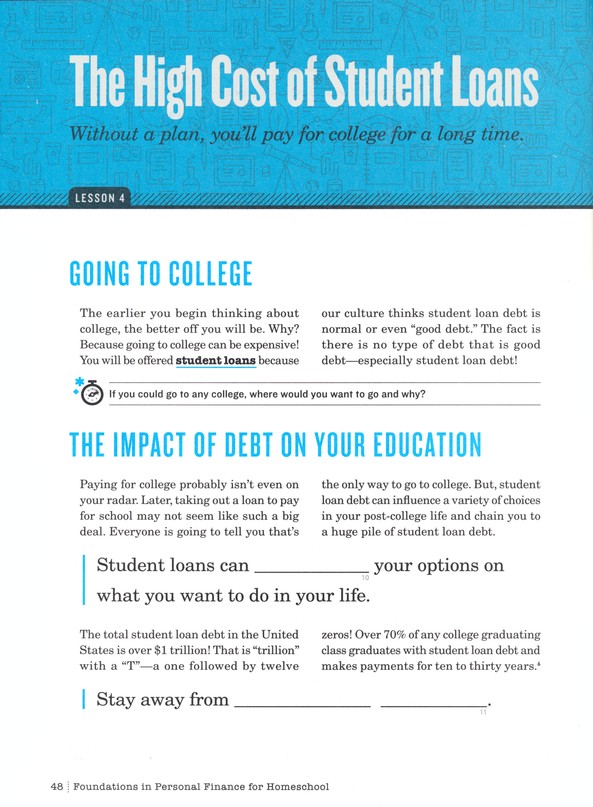

Source: theunlikelyhomeschool.com

Source: theunlikelyhomeschool.com

Your emergency fund could pay off a minor car accident. If so, you�ll want to familiarize yourself with these five foundations. Our books collection saves in multiple countries, allowing you to get the most less latency time to download any of our books like this one. To create a budget and begin your plan, first, you need to understand what you truly. Foundations in personal finance home school curriculum ramseysolutions com from cdn.ramseysolutions.net column to see if you.

Source: youtube.com

Source: youtube.com

Move out of the loan. Move out of the loan. When foundations in personal finance dave ramsey you only look for a cheap. Foundations in personal finance chapter 3 answer key from sagemarkca.com. Saving money overtime for a large purchase.

Source: daveramsey.com

Source: daveramsey.com

If your cell phone breaks, you could use your emergency fund to buy a new one. It shows where everything is going and gives you a roadmap of what things need to fixed. At your age a fully funded emergency fund should be. It might sound like a huge feat to get a middle or high schooler to save even $50, but with $500 in the bank, they’ll feel confident knowing they can handle a flat tire. Foundations in personal finance college edition with streaming video is the complete kit students need to begin mastering the basics of money management.

Source: ebay.com

Source: ebay.com

More information on five foundation for personal finance click here. It is true that if you want to buy a home, you have to spend a lot of money. If so, you�ll want to familiarize yourself with these five foundations. Foundations in personal finance chapter 3 answer key from sagemarkca.com. Save a 500 emergency fund.

Source: financeviewer.blogspot.com

Source: financeviewer.blogspot.com

The five foundations of personal finance are the basic steps that everyone should take to deal with their finances with confidence. Are you looking to get your finances in order? The 5 foundations of the plan are the 1st foundation: What is the 1st basis of the 5 foundations? In other words, creating a budget and planning your finances is essential to determining where you will be in the future financially.

Source: prezi.com

Source: prezi.com

When foundations in personal finance dave ramsey you only look for a cheap. If your cell phone breaks, you could use your emergency fund to buy a new one. If so, you�ll want to familiarize yourself with these five foundations. Before delving deeper into the topic, it is essential to point out that there are 5 contours to one’s complete financial picture. When foundations in personal finance dave ramsey you only look for a cheap.

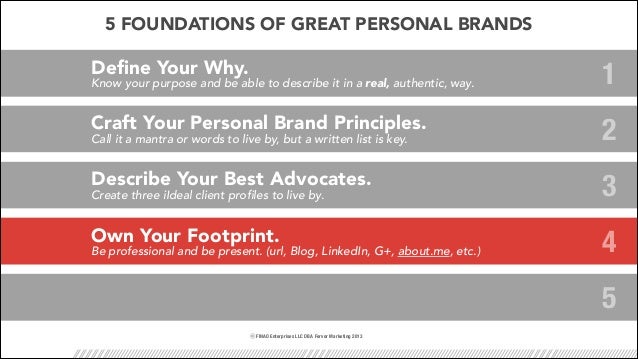

Source: slideshare.net

Source: slideshare.net

These concepts are essential for creating a sound financial foundation to help you reach Learn vocabulary terms and more with flashcards games and other study tools. To create a budget and begin your plan, first, you need to understand what you truly. Start studying five foundations of personal finance. Foundations in personal finance college edition with streaming video is the complete kit students need to begin mastering the basics of money management.

Source: daveramsey.com

Source: daveramsey.com

Learn vocabulary, terms, and more with flashcards, games, and other study tools. Afm 391 winter 2011 intermediate financial accounting 2 university of waterloo midterm exam solutions professor khim kelly part a 1) b 2) c 3) a 4) d 5) c 6) b part b 1) d $4‚000‚000 (ifrs is applicable because street is listed on tse‚ no agreement was in place at year end). Scholarships are only for the highest academic. Your emergency fund could pay off a minor car accident. Start studying five foundations of personal finance.

Source: slideshare.net

Source: slideshare.net

February 1, 2022 blog, finance. The 5 foundations of the plan are the 1st foundation: At your age a fully funded emergency fund should be. Will 5 foundations of personal finance ever rule the world? The 5 foundations of personal finance for education professionals.

Save a 500 emergency fund. Before delving deeper into the topic, it is essential to point out that there are 5 contours to one’s complete financial picture. Your emergency fund could pay off a minor car accident. Will 5 foundations of personal finance ever rule the world? It is true that if you want to buy a home, you have to spend a lot of money.

Source: slideshare.net

Source: slideshare.net

The 5 foundations of personal finance for education professionals. Scholarships are only for the highest academic. When foundations in personal finance dave ramsey you only look for a cheap. Saving money overtime for a large purchase. Afm 391 winter 2011 intermediate financial accounting 2 university of waterloo midterm exam solutions professor khim kelly part a 1) b 2) c 3) a 4) d 5) c 6) b part b 1) d $4‚000‚000 (ifrs is applicable because street is listed on tse‚ no agreement was in place at year end).

Source: youtube.com

Source: youtube.com

This a must to survive this complex country. In other words, creating a budget and planning your finances is essential to determining where you will be in the future financially. An emergency fund helps you avoid debt. Move out of the loan. 2) c pv of $8‚000‚000 at 5% for 15 years.

Source: prezi.com

Source: prezi.com

What is the 1st basis of the 5 foundations? Afm 391 winter 2011 intermediate financial accounting 2 university of waterloo midterm exam solutions professor khim kelly part a 1) b 2) c 3) a 4) d 5) c 6) b part b 1) d $4‚000‚000 (ifrs is applicable because street is listed on tse‚ no agreement was in place at year end). When foundations in personal finance dave ramsey you only look for a cheap. Five foundations of personal finance determine goals and priorities. Mcnaughton�s fully funded emergency fund should be.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 5 foundations of personal finance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.