Which of the following is an inventory costing method

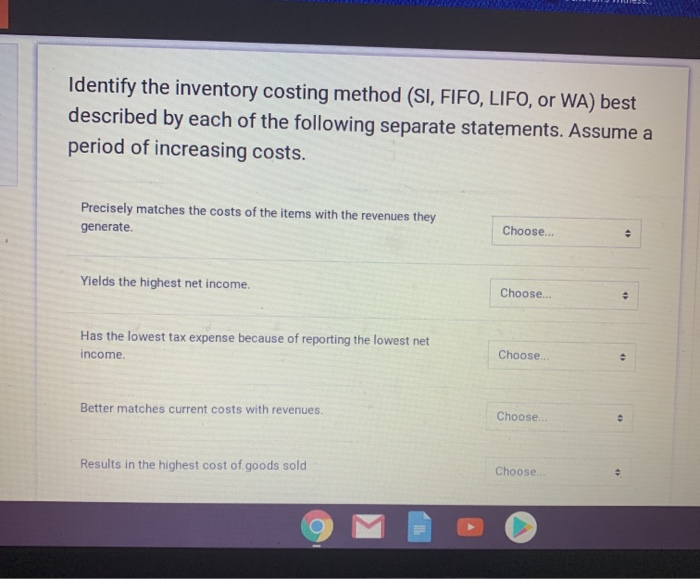

Which Of The Following Is An Inventory Costing Method. Which of the following is not an acceptable inventory costing method? When inventory costs are declining, which of the following inventory costing method will result in the lowest ending merchandise inventory? The following points highlight the generally accepted methods of inventory pricing, each based on a different assumption of cost flow. You can perform this calculation in excel by entering the following formula.

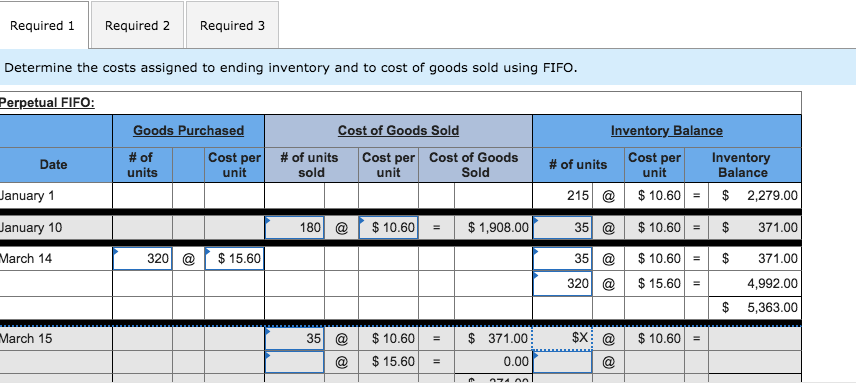

Solved Required Hemming Uses A Perpetual Inventory Syste… From chegg.com

Solved Required Hemming Uses A Perpetual Inventory Syste… From chegg.com

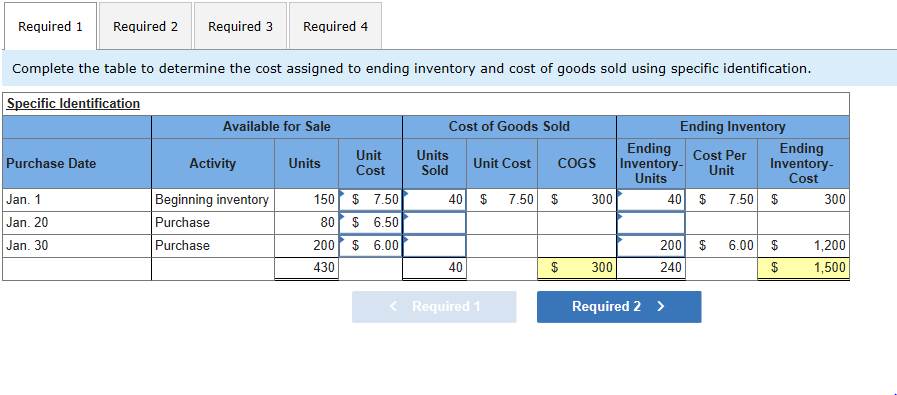

Since the theory perfectly matches. First− in,first−out c.specific identification d. Then identify the cost of ending inventory and cost of goods sold for the month. The company would report an inventory on the balance sheet for $423. A method of calculating the cost of sale in which a weighted average cost of inventory is calculated after each purchase. There are several possible inventory.

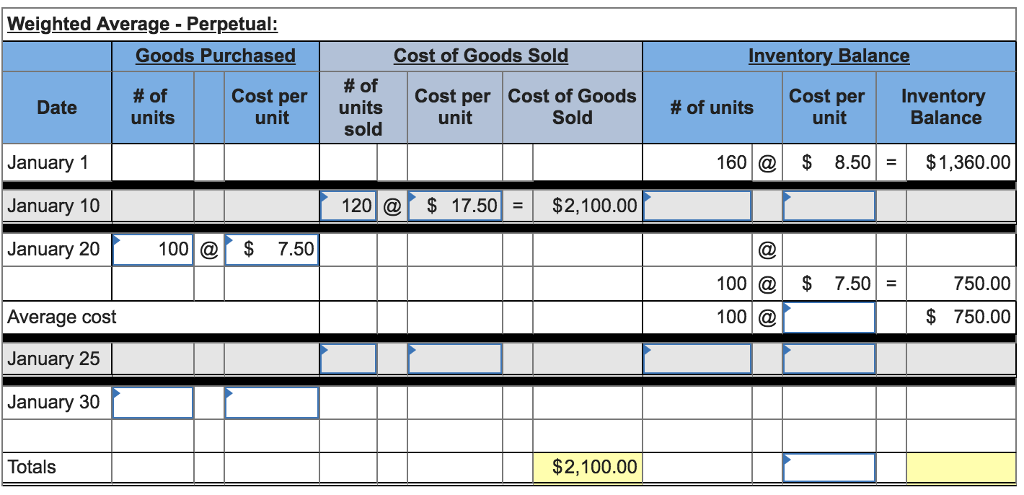

Weighted average method is characterized by all of the following except:

Question 10 which of the following is not an inventory costing method? Sold 10 oranges @ $1.00 each. Which of the following inventory costing methods is based on the actual cost of each particular unit of inventory? Purchased 5 oranges @ $0.20 each. The following are various inventory control techniques and methods used in different industries: It is a method of valuation of the inventory.

Source: chegg.com

Source: chegg.com

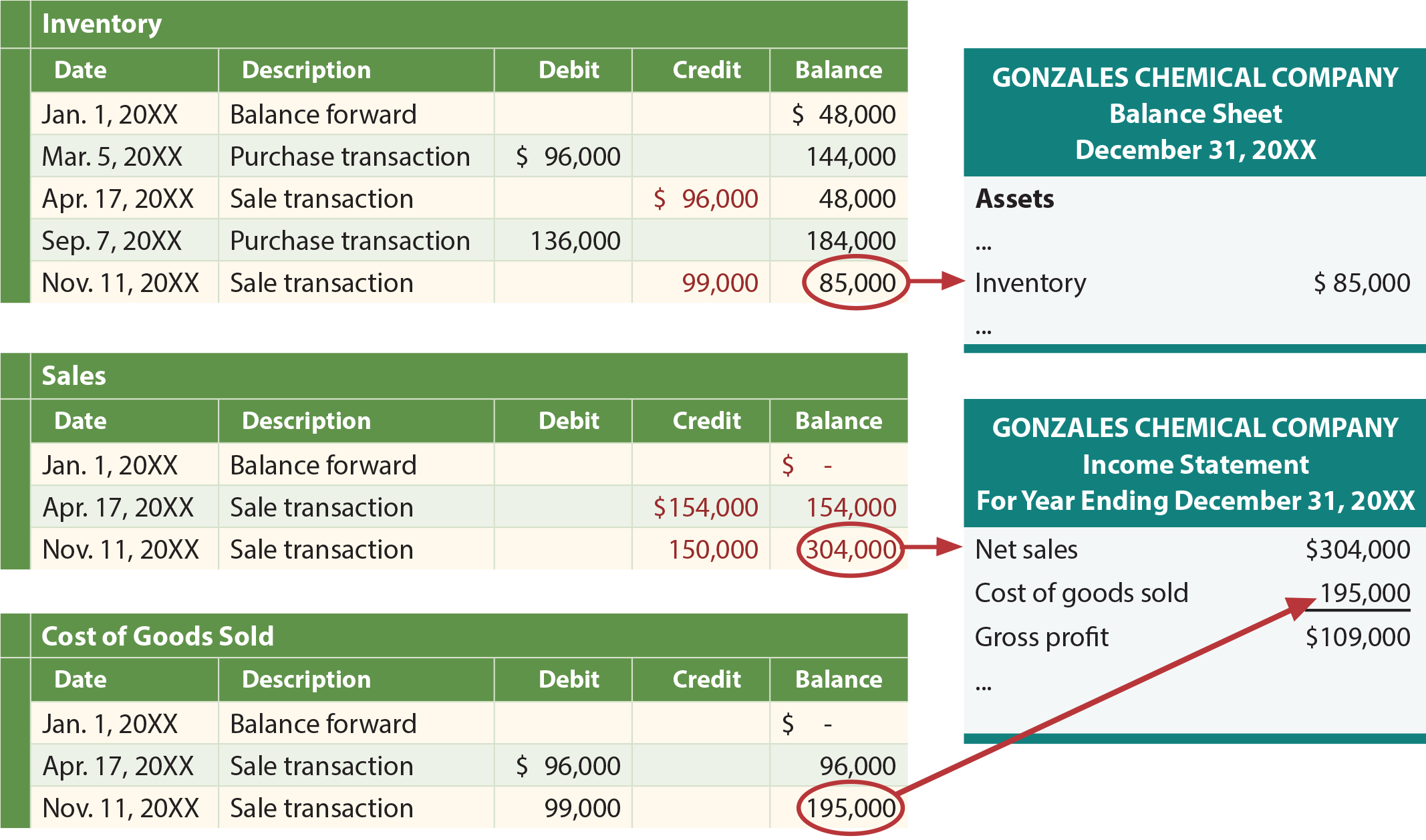

A method of calculating the cost of sale in which a weighted average cost of inventory is calculated after each purchase. Which of the following is not an acceptable inventory costing method? Thus, the cost of goods sold is largely based on the cost assigned to ending inventory, which brings us back to the accounting method used to do so. The following are various inventory control techniques and methods used in different industries: Different inventory costing methods can bring the different cost of goods sold results.

Source: chegg.com

Source: chegg.com

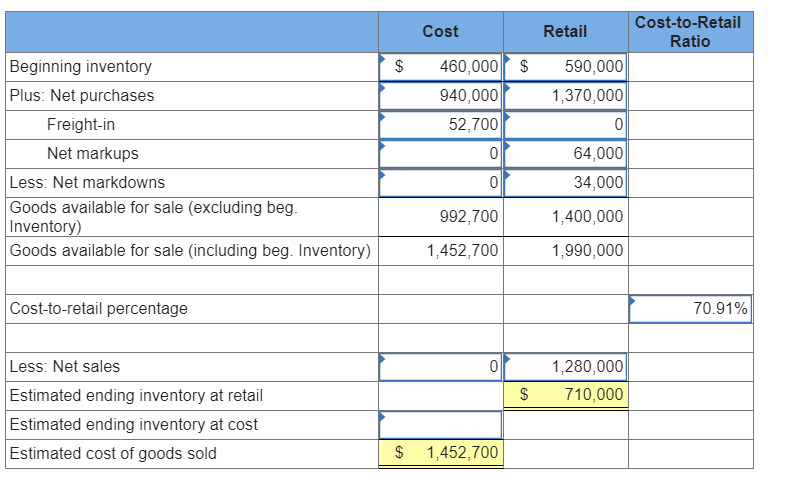

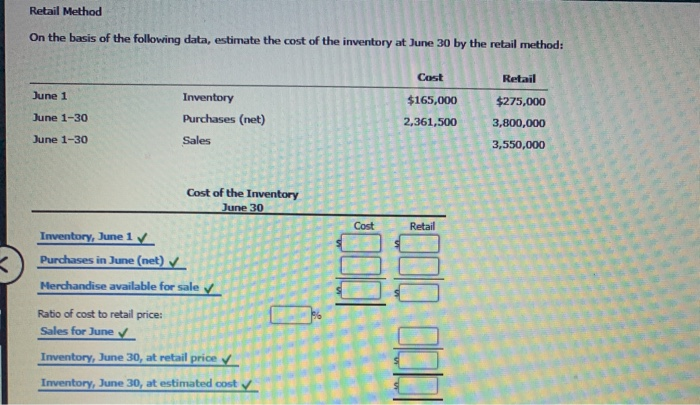

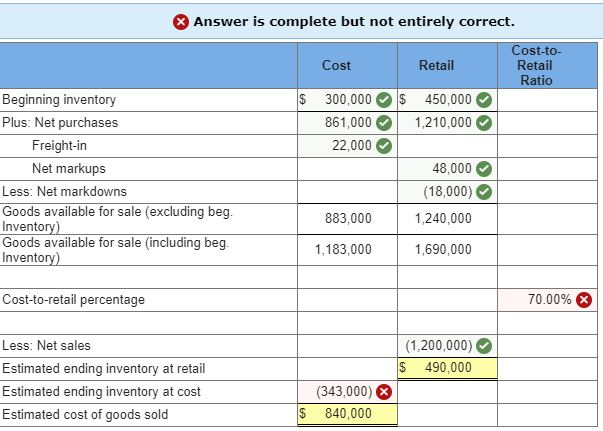

The retail method measures the cost of inventory compared to the price of goods to get an ending inventory balance for a business. Which of the following is not an acceptable inventory. If a pair of sunglasses is purchased on 5/1/2021, the fifo method would assume the. In other words, it determines how much expense should be recognized in this time versus the next. Which of the following is not an inventory costing method?

Source: homeworklib.com

Source: homeworklib.com

Stock take is not the methods of inventory costing. The gross profit will go up, and hence, taxable income will also go up. Inventory costing methods place primary reliance on assumptions about the flow of a. Purchased 5 oranges @ $0.10 each. On the other hand, if a method assigns a lower value to inventory, the cost of goods sold will go up.

Source: chegg.com

Source: chegg.com

The retail method measures the cost of inventory compared to the price of goods to get an ending inventory balance for a business. Question 10 which of the following is not an inventory costing method? Then identify the cost of ending inventory and cost of goods sold for the month. This may be done to provide an audit of existing stock. Which of the following is not an acceptable inventory.

Source: homeworklib.com

Source: homeworklib.com

The company would report an inventory on the balance sheet for $423. Which of the following inventory costing methods is based on the actual cost of each particular unit of inventory? It helps a business determine its cost of goods sold and eventually in gross profits. Which of the following is not an inventory costing method? Different inventory costing methods can bring the different cost of goods sold results.

Source: chegg.com

Source: chegg.com

In other words, it determines how much expense should be recognized in this time versus the next. Since the theory perfectly matches. Thus, the cost of goods sold is largely based on the cost assigned to ending inventory, which brings us back to the accounting method used to do so. Purchased 5 oranges @ $0.20 each. The retail inventory costing method.

On the other hand, if a method assigns a lower value to inventory, the cost of goods sold will go up. Thus, the cost of goods sold is largely based on the cost assigned to ending inventory, which brings us back to the accounting method used to do so. This weighted average cost is then multiplied by the number of inventory items. Which of the following is not an acceptable inventory. Inventory costing methods place primary reliance on assumptions about the flow of a.

Source: homeworklib.com

Source: homeworklib.com

Although a business can use any inventory costing method. Solution (by examveda team) fifo methods of inventory costing produces ending stock cost close to the market value of the inventory. There are several possible inventory. Which of the following is not an acceptable inventory costing method? Which of the following is not an acceptable inventory.

Source: goodttorials.blogspot.com

Source: goodttorials.blogspot.com

You can perform this calculation in excel by entering the following formula. The following are various inventory control techniques and methods used in different industries: First− in,first−out c.specific identification d. Thus, the cost of goods sold is largely based on the cost assigned to ending inventory, which brings us back to the accounting method used to do so. Purchased 5 oranges @ $0.10 each.

Source: chegg.com

Source: chegg.com

If a technique assigns a high value to inventory, the cost of goods sold will go down. Different inventory costing methods can bring the different cost of goods sold results. Then identify the cost of ending inventory and cost of goods sold for the month. Purchased 5 oranges @ $0.20 each. This may be done to provide an audit of existing stock.

Source: chegg.com

Source: chegg.com

It helps a business determine its cost of goods sold and eventually in gross profits. Weighted average method is characterized by all of the following except: This weighted average cost is then multiplied by the number of inventory items. Different inventory costing methods can give different values of inventory in hand. Let’s do the math using the fifo method to figure out your remaining inventory costs on thursday, as well as what your paper profit would be.

Source: chegg.com

Source: chegg.com

It is a method of valuation of the inventory. The retail method measures the cost of inventory compared to the price of goods to get an ending inventory balance for a business. In other words, it determines how much expense should be recognized in this time versus the next. The gross profit will go up, and hence, taxable income will also go up. It is a cost flow assumption for most companies.

Source: chegg.com

Source: chegg.com

Solution (by examveda team) fifo methods of inventory costing produces ending stock cost close to the market value of the inventory. Inventory costing methods place primary reliance on assumptions about the flow of a. If a technique assigns a high value to inventory, the cost of goods sold will go down. The retail inventory costing method. The fifo method follows the principle that materials received first are issued first.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Weighted average method is characterized by all of the following except: Inventory costing is an integral part of inventory control and inventory management. Since the theory perfectly matches. Sold 10 oranges @ $1.00 each. Question 10 which of the following is not an inventory costing method?

Source: chegg.com

Source: chegg.com

Which of the following is not an inventory costing method? Purchased 5 oranges @ $0.20 each. Different inventory costing methods can bring the different cost of goods sold results. Let’s do the math using the fifo method to figure out your remaining inventory costs on thursday, as well as what your paper profit would be. Which of the following is not an inventory costing method?

Source: brainly.com

Source: brainly.com

Inventory costing is an integral part of inventory control and inventory management. In other words, it determines how much expense should be recognized in this time versus the next. The following points highlight the generally accepted methods of inventory pricing, each based on a different assumption of cost flow. Sold 10 oranges @ $1.00 each. Different inventory costing methods can give different values of inventory in hand.

Source: brainly.com

Source: brainly.com

When inventory costs are declining, which of the following inventory costing method will result in the lowest ending merchandise inventory? If a technique assigns a high value to inventory, the cost of goods sold will go down. The retail method measures the cost of inventory compared to the price of goods to get an ending inventory balance for a business. Let’s do the math using the fifo method to figure out your remaining inventory costs on thursday, as well as what your paper profit would be. Purchased 5 oranges @ $0.10 each.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which of the following is an inventory costing method by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.