Right of return accounting

Right Of Return Accounting. (2) buyer’s obligation to pay is not contingent on resale of the product; “because, in many cases, the number of returns is expected to be only a small percentage of the total sales and the return period is often short (such as 30 days), the boards decided that the incremental information provided to users of financial statements by accounting for the return right service as a performance obligation would not have. Revenue for the transferred products in the amount of consideration to. A right of return is not a separate performance obligation under the new standard, but it affects the estimated transaction price for transferred goods.

Purchase Return Logo Right (With Price) Business & Accounting Software From enterpryze.com

Purchase Return Logo Right (With Price) Business & Accounting Software From enterpryze.com

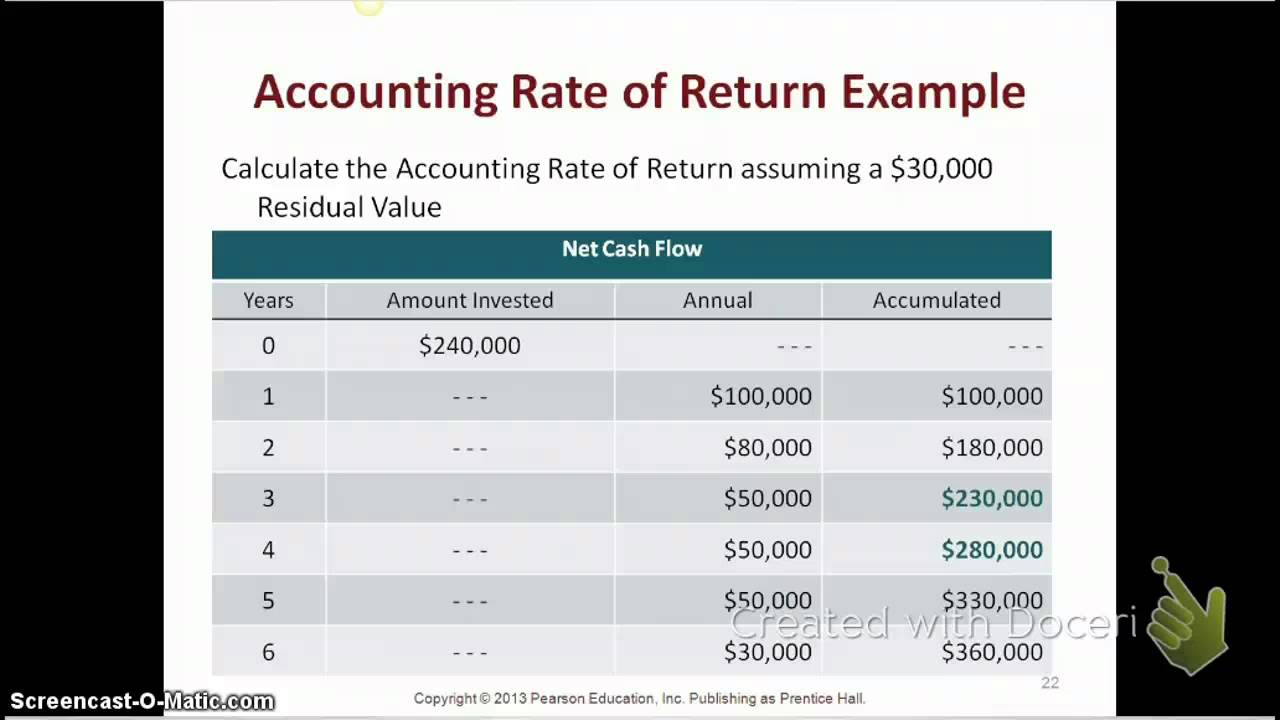

Even if goods are not faulty many retailers have a goodwill policy allowing returns within a specified period. Accounting rate of return is a simple and quick way to examine a proposed investment to see if it meets a business’s standard for minimum required return. The estimated value of damaged goods is $200. (3) buyer must pay for item if lost; “because, in many cases, the number of returns is expected to be only a small percentage of the total sales and the return period is often short (such as 30 days), the boards decided that the incremental information provided to users of financial statements by accounting for the return right service as a performance obligation would not have. A right of return is not a separate performance obligation under the new standard, but it affects the estimated transaction price for transferred goods.

While many states afford their citizens the right of abode, the right of.

The dresses cost $200 each and customers have a right of return for 4 months after purchase. The estimated value of damaged goods is $200. Option of purchaser to give goods back to the seller for full credit. The formula for the accounting rate of return is as follows: Loginask is here to help you access right of return accounting quickly and handle each specific case you encounter. The restocking fee is generally intended to compensate the entity for costs associated with the product return (e.g.

Source: nerdcounter.com

Source: nerdcounter.com

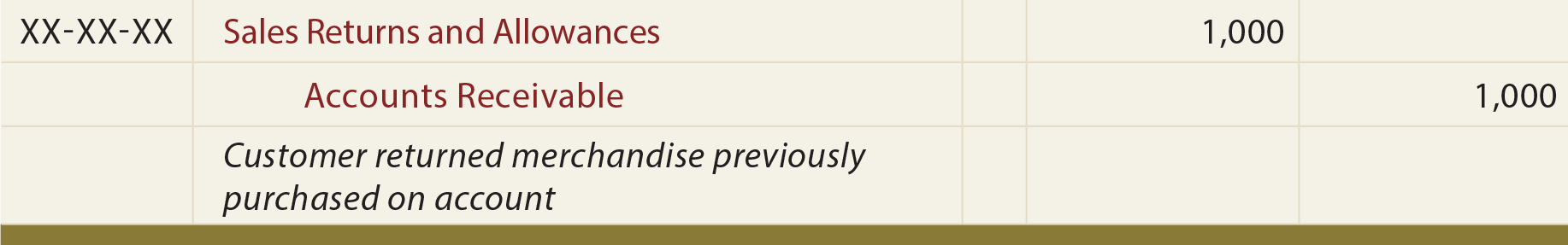

The buyer’s right to return merchandise precludes revenue recognition by the seller at the time of sale unless all of the following conditions are met: Furthermore, you can find the “troubleshooting login issues” section which can answer your unresolved problems and equip you. A credit that can be applied. The potential return of merchandise by a customer must be accounted for in accordance with gaap (generally accepted accounting principles) whenever a buyer has a future right of return. Customer does not return goods but due to some issues with goods, the company provides a $500 allowance to the customer account.

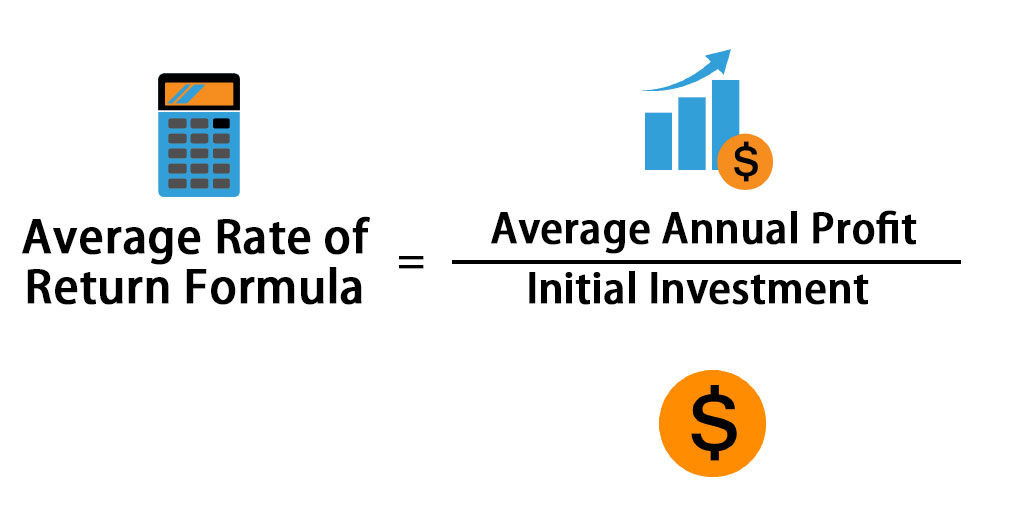

In return, the customer may receive a full or partial refund of any consideration paid; Question retailer g sold 100 dresses for $300 each in december 2018. Customer does not return goods but due to some issues with goods, the company provides a $500 allowance to the customer account. Accounting rate of return (arr) is the average net income an asset is expected to generate divided by its average capital cost, expressed as an annual percentage. In accordance with generally accepted accounting principles, when a buyer has a right to return a product in the future in accordance with formal or informal agreement, a seller may or may not be able to recognize revenue at the time of sale.

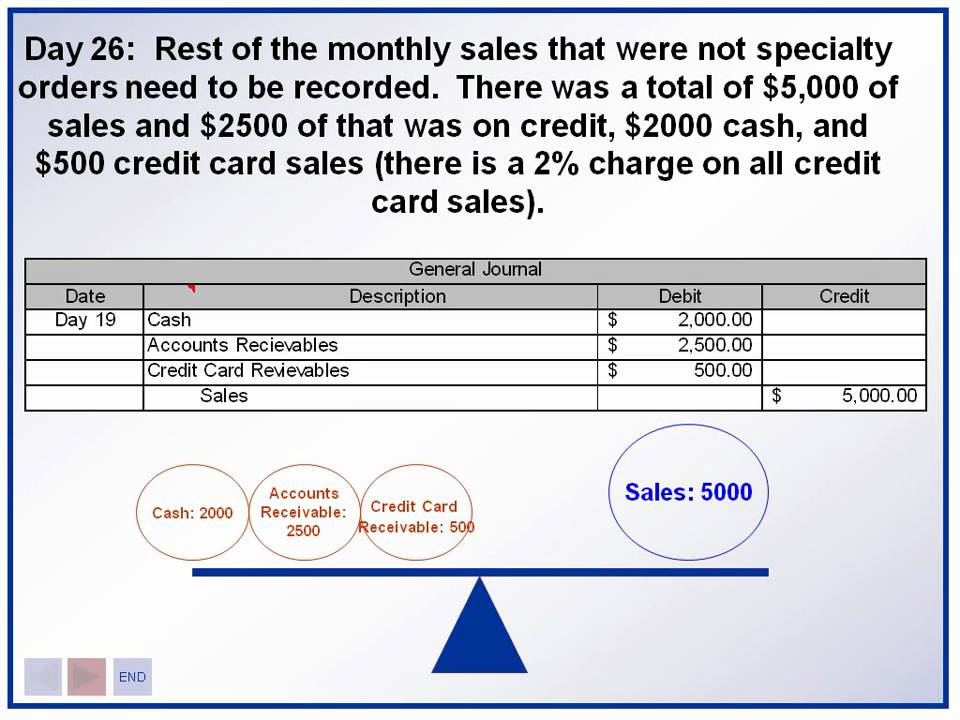

Source: youtube.com

Source: youtube.com

Average annual accounting profit ÷ initial investment = accounting rate of return. Shipping and repacking costs) or the reduction in the selling price that an entity may achieve when reselling the product. A business should create a reserve for product returns in situations where there is a right of return linked to the sale of goods. Option of purchaser to give goods back to the seller for full credit. Customer returns goods due to the damage.

Source: investwalls.blogspot.com

Source: investwalls.blogspot.com

(1) selling price is determinable; Accounting rate of return (arr) is the average net income an asset is expected to generate divided by its average capital cost, expressed as an annual percentage. The restocking fee is generally intended to compensate the entity for costs associated with the product return (e.g. Customers have a legal right to return goods that are faulty, not as described, or unfit for purpose. To record the sale of 1,000 units, the company would make the following journal entries at the time of sale:

Source: pinterest.com

Source: pinterest.com

With the example of sales return, we have the journal entry for each case scenario as below: (1) selling price is determinable; Customer returns goods due to the damage. Even if goods are not faulty many retailers have a goodwill policy allowing returns within a specified period. Average annual accounting profit ÷ initial investment = accounting rate of return.

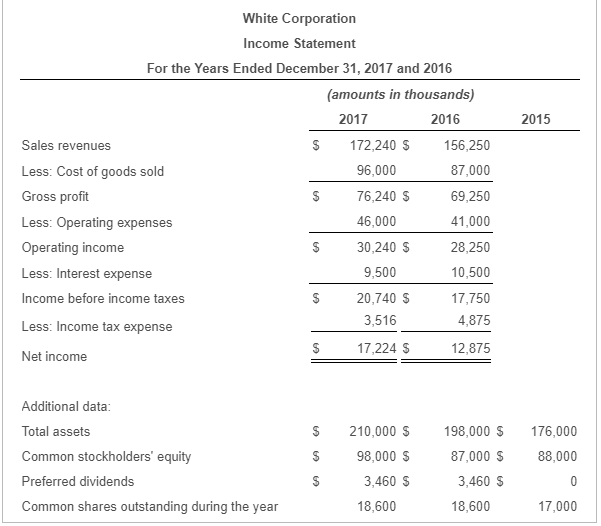

Source: chegg.com

Source: chegg.com

Option of purchaser to give goods back to the seller for full credit. Right of return accounting will sometimes glitch and take you a long time to try different solutions. While many states afford their citizens the right of abode, the right of. The dresses cost $200 each and customers have a right of return for 4 months after purchase. It may not be possible to derive a reasonable estimate of what future product returns may be under the following circumstances:

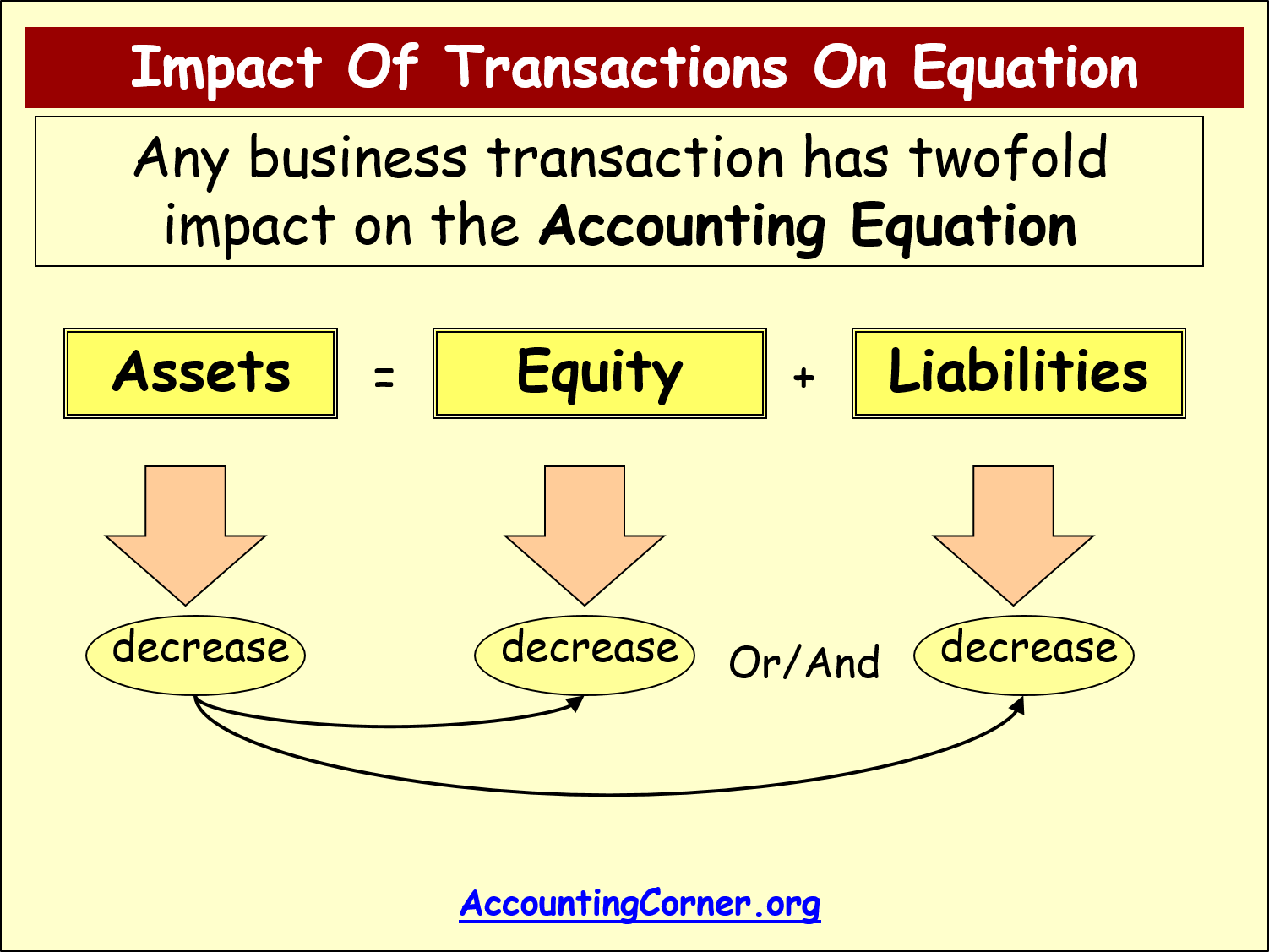

Source: accountingcorner.org

Source: accountingcorner.org

Sales return is the return of merchandise by a customer. The accounting rate of return (arr) is the amount of profit, or return, an individual can expect based on an investment made. Average annual accounting profit ÷ initial investment = accounting rate of return. Accounting rate of return is a simple and quick way to examine a proposed investment to see if it meets a business’s standard for minimum required return. Customer returns goods due to the damage.

Source: accountingcorner.org

Source: accountingcorner.org

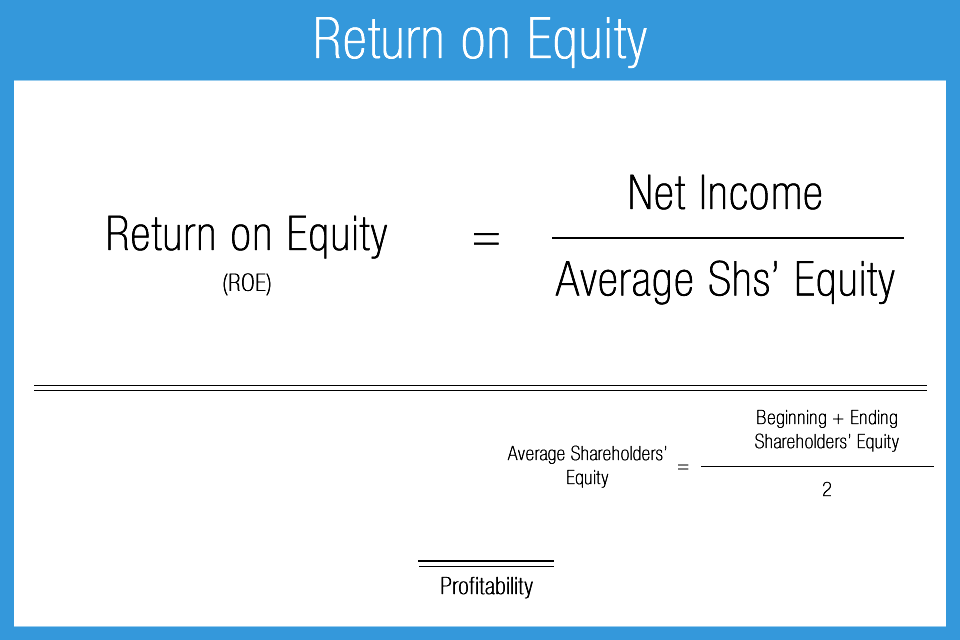

A credit that can be applied. Return on assets (roa) is a type of return on investment (roi) metric that measures the profitability of a business in relation to its total assets.this ratio indicates how well a company is performing by comparing the profit it’s generating to the capital it’s invested in assets.the higher the return, the more productive and. Ifrs 15 has prescriptive guidance on. (2) buyer’s obligation to pay is not contingent on resale of the product; A right of return often entitles a customer to a full or partial refund of the amount paid or a credit against the value of previous or future purchases.

Source: coreco.co.uk

Source: coreco.co.uk

To account for the transfer of products with a right of return (and for some services that are provided subject to a refund), an entity should recognize all of the following: Return on assets (roa) is a type of return on investment (roi) metric that measures the profitability of a business in relation to its total assets.this ratio indicates how well a company is performing by comparing the profit it’s generating to the capital it’s invested in assets.the higher the return, the more productive and. To record the sale of 1,000 units, the company would make the following journal entries at the time of sale: (1) selling price is determinable; Even if goods are not faulty many retailers have a goodwill policy allowing returns within a specified period.

Source: accountingcorner.org

Source: accountingcorner.org

Customer does not return goods but due to some issues with goods, the company provides a $500 allowance to the customer account. Question retailer g sold 100 dresses for $300 each in december 2018. With the example of sales return, we have the journal entry for each case scenario as below: The buyer’s right to return merchandise precludes revenue recognition by the seller at the time of sale unless all of the following conditions are met: While many states afford their citizens the right of abode, the right of.

Source: jetpackworkflow.com

Source: jetpackworkflow.com

Customer does not return goods but due to some issues with goods, the company provides a $500 allowance to the customer account. Demand levels could change, depending upon technological. To account for the transfer of products with a right of return (and for some services that are provided subject to a refund), an entity should recognize all of the following: Revenue is only recognized for those. Roa formula / return on assets calculation.

Source: youtube.com

Source: youtube.com

It may not be possible to derive a reasonable estimate of what future product returns may be under the following circumstances: (3) buyer must pay for item if lost; Question retailer g sold 100 dresses for $300 each in december 2018. Average annual accounting profit ÷ initial investment = accounting rate of return. A right of return often entitles a customer to a full or partial refund of the amount paid or a credit against the value of previous or future purchases.

Source: londonderryaccountant.com

Source: londonderryaccountant.com

Accounting rate of return divides the. Loginask is here to help you access right of return accounting quickly and handle each specific case you encounter. The restocking fee is generally intended to compensate the entity for costs associated with the product return (e.g. “because, in many cases, the number of returns is expected to be only a small percentage of the total sales and the return period is often short (such as 30 days), the boards decided that the incremental information provided to users of financial statements by accounting for the return right service as a performance obligation would not have. In accordance with generally accepted accounting principles, when a buyer has a right to return a product in the future in accordance with formal or informal agreement, a seller may or may not be able to recognize revenue at the time of sale.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

The estimated value of damaged goods is $200. Shipping and repacking costs) or the reduction in the selling price that an entity may achieve when reselling the product. Customer does not return goods but due to some issues with goods, the company provides a $500 allowance to the customer account. To record the sale of 1,000 units, the company would make the following journal entries at the time of sale: “because, in many cases, the number of returns is expected to be only a small percentage of the total sales and the return period is often short (such as 30 days), the boards decided that the incremental information provided to users of financial statements by accounting for the return right service as a performance obligation would not have.

The accounting rate of return of max ltd from this project will be 17.2%. Right of return accounting will sometimes glitch and take you a long time to try different solutions. A right of return often entitles a customer to a full or partial refund of the amount paid or a credit against the value of previous or future purchases. Demand levels could change, depending upon technological. Shipping and repacking costs) or the reduction in the selling price that an entity may achieve when reselling the product.

Source: enterpryze.com

Source: enterpryze.com

Pinterest.com accounting rate of return arr is a formula that reflects the percentage rate of return expected on an investment or asset compared to the initial investments cost. Accounting rate of return is a simple and quick way to examine a proposed investment to see if it meets a business’s standard for minimum required return. This may be in accordance with formal or informal agreements between buyer and seller. The accounting rate of return (arr) is the amount of profit, or return, an individual can expect based on an investment made. The restocking fee is generally intended to compensate the entity for costs associated with the product return (e.g.

Source: accountingplay.com

Source: accountingplay.com

“because, in many cases, the number of returns is expected to be only a small percentage of the total sales and the return period is often short (such as 30 days), the boards decided that the incremental information provided to users of financial statements by accounting for the return right service as a performance obligation would not have. Customer returns goods due to the damage. In accordance with generally accepted accounting principles, when a buyer has a right to return a product in the future in accordance with formal or informal agreement, a seller may or may not be able to recognize revenue at the time of sale. Even if goods are not faulty many retailers have a goodwill policy allowing returns within a specified period. Accounting rate of return is a simple and quick way to examine a proposed investment to see if it meets a business’s standard for minimum required return.

Source: pinterest.com

Source: pinterest.com

Instead, the retailer would recognise a refund liability together with an asset for the right to recover the goods sold. In accordance with generally accepted accounting principles, when a buyer has a right to return a product in the future in accordance with formal or informal agreement, a seller may or may not be able to recognize revenue at the time of sale. The accounting rate of return (arr) is the amount of profit, or return, an individual can expect based on an investment made. The dresses cost $200 each and customers have a right of return for 4 months after purchase. Rather than looking at cash flows , as other investment evaluation tools like net present value and internal rate of return do, accounting rate of return examines net income.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title right of return accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.