How does quickbooks calculate finance charges

How Does Quickbooks Calculate Finance Charges. At this time, you can exclude the old charges from your record. 2.4% + 25 cents for swiping a credit card. Note that quickbooks displays the a/r account field only when your chart of accounts. Choose the appropriate a/r account.

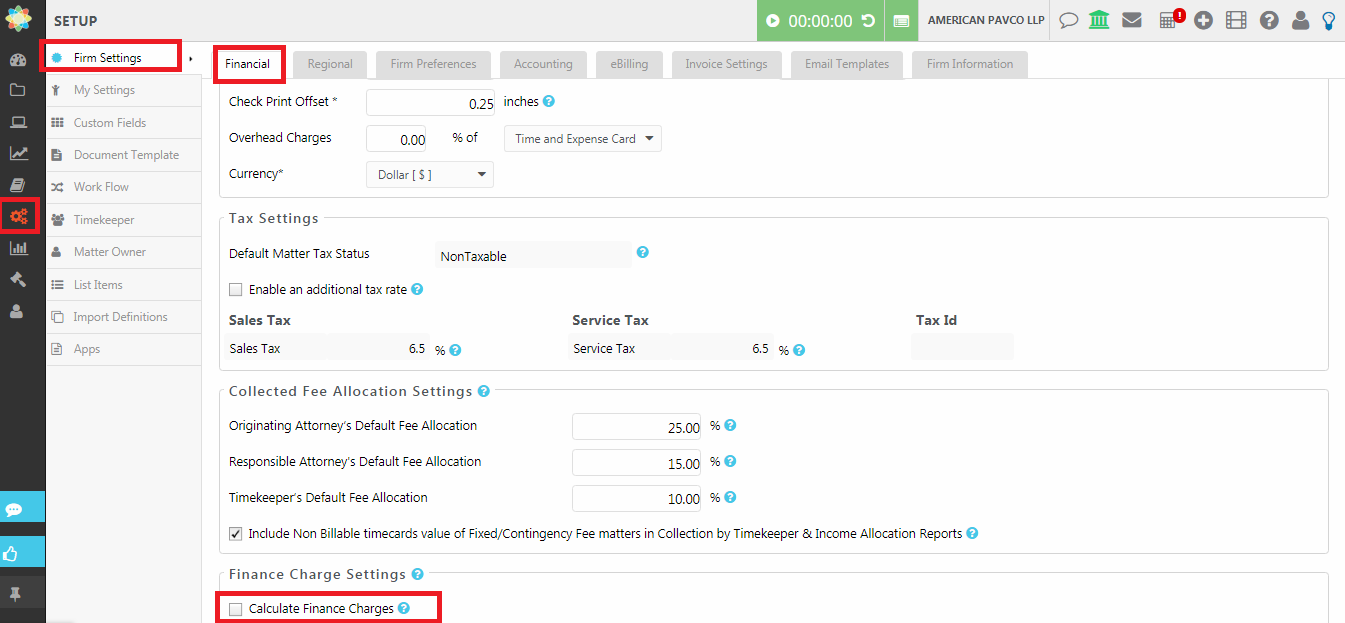

Calculate Finance Charges in QuickBooks ! Call +1(800)9934190 From 99accounting.com

Calculate Finance Charges in QuickBooks ! Call +1(800)9934190 From 99accounting.com

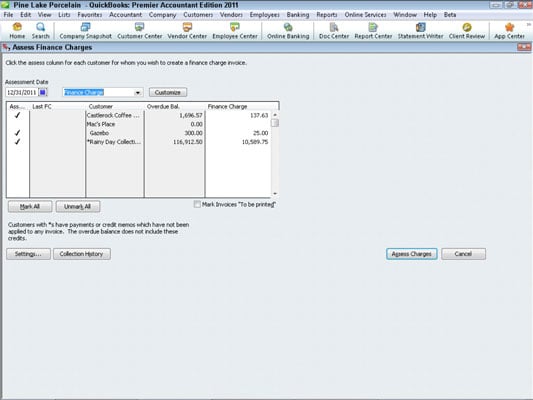

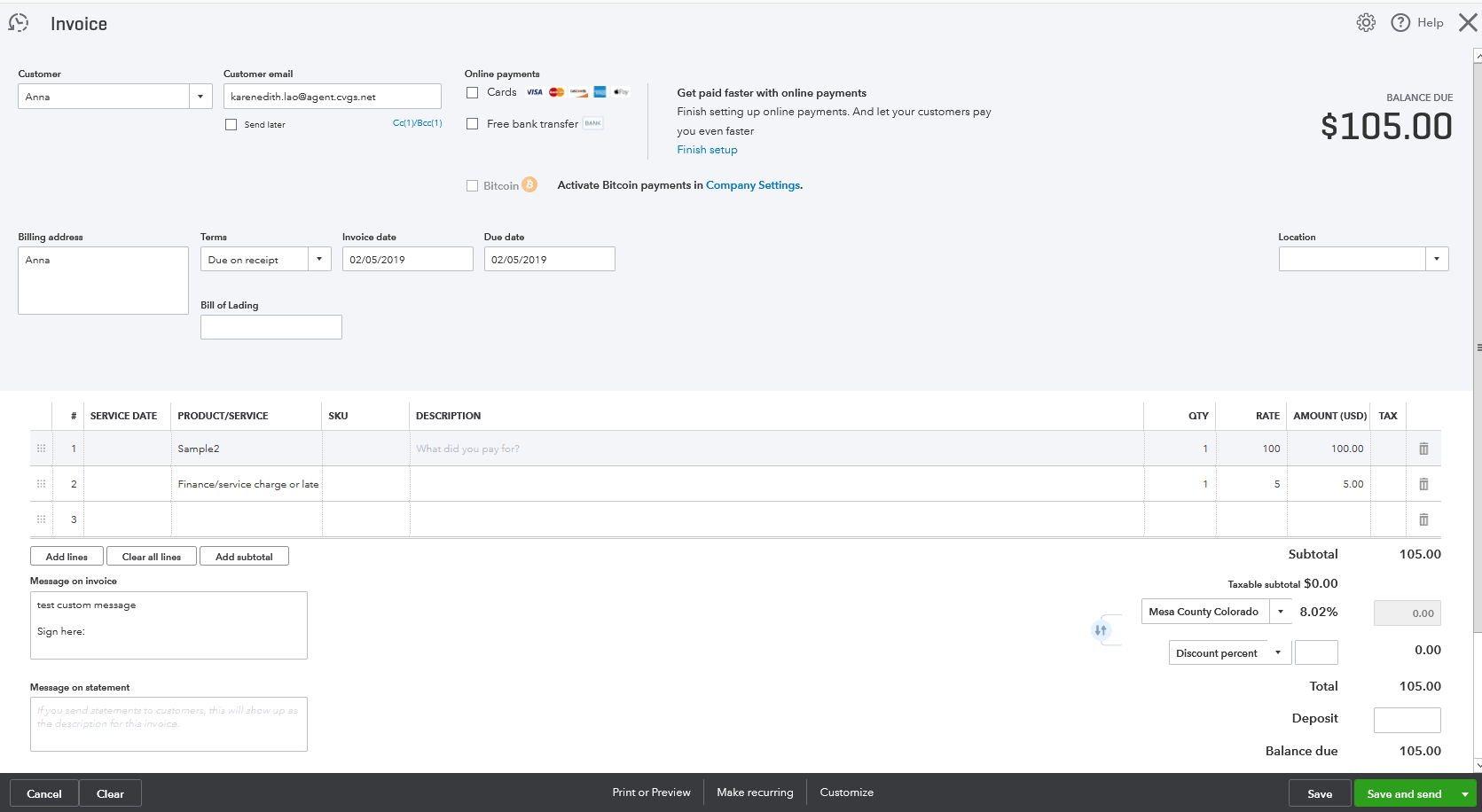

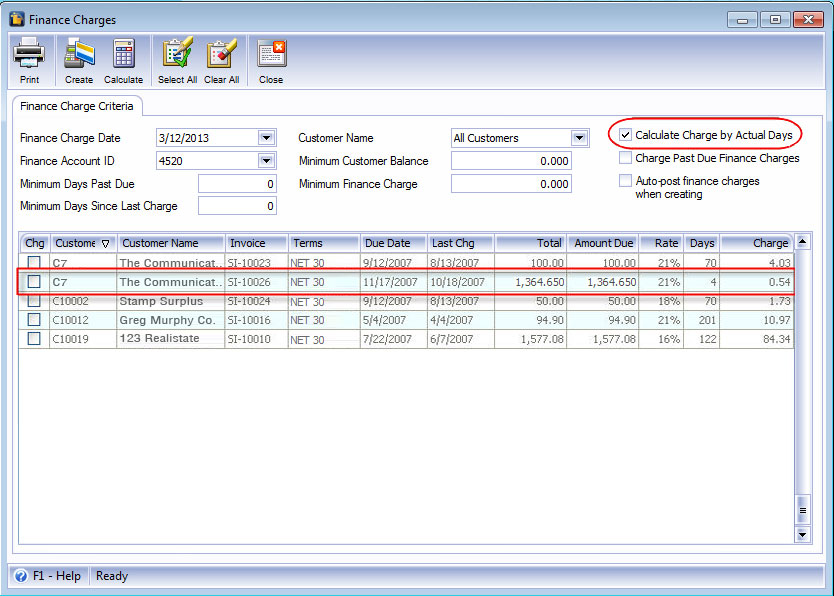

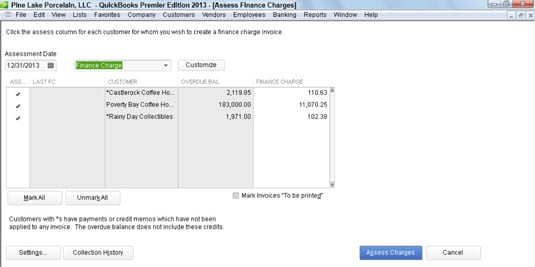

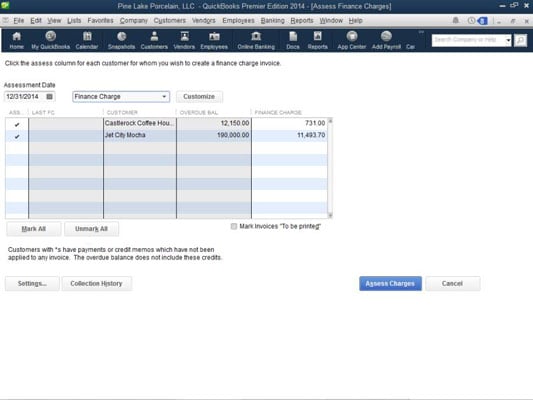

You’ll see something like this: Go to quickbooks company file and login as admin. You can see your finance charge invoices when you go to print them. Enter the date for which you want to assess finance charges in the assessment box. This quickbooks receivables training tutorial will show you how quickbooks calculates interest when assessing finance charges to customers. You’ll see something like this:

Calculate the finance charges in quickbooks is one of the most important features of quickbooks software.

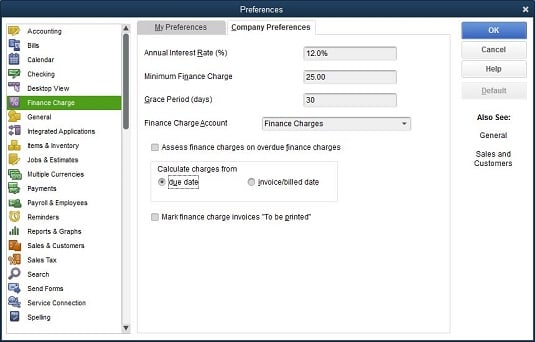

Enter the “ annual interest rate,” “minimum finance charge,” & “grace period (days).”. You’ll determine who should have finance charge invoices created in the assess finance charges window. You will see something like this: Open the edit menu and select preferences. Calculate the finance charges in quickbooks is one of the most important features of quickbooks software. 1% (max $10) for ach bank transfers.

Source: financeviewer.blogspot.com

Significant level bookkeeping ($670 each month) serves organizations with $150,001 or more in month to month costs. Enter the date for which you want to assess finance charges in the assessment box. It costs $270 each month. When it’s time to print, open the file menu and select print forms | invoices. You will see something like this:

Source: dummies.com

Source: dummies.com

You’ll determine who should have finance charge invoices created in the assess finance charges window. Click the finance charge tab in the left vertical pane, then the company preferences tab in the window that opens. In addition to discussing these fees with your customers at the beginning of a new. Hit yes to confirm the action. Calculate the finance charges in quickbooks is one of the most important features of quickbooks software.

Source: efprgroup.com

Your finance charges have now been recorded in quickbooks as individual invoices. First, let’s create a service fee item from the sales tab and then add it to their current invoices. Quickbooks does not automatically add finance charges to your tenants’ invoices. You’ll see something like this: You can see your finance charge invoices when you go to print them.

Click in the assess column to place a check mark beside each overdue invoice for which you want to assess finance charges. Let me show you how: You’ll see something like this: There is no agreement included; You’ll see something like this:

Source: dummies.com

Source: dummies.com

Choose the appropriate a/r account. Navigate to the sales menu and click products and services. Enter the “ annual interest rate,” “minimum finance charge,” & “grace period (days).”. Click the finance charge tab in the left vertical pane, then the company preferences tab in the window that opens. Click in the assess column to place a check mark beside each overdue invoice for which you want to assess finance charges.

Source: 99accounting.com

Source: 99accounting.com

Fill in the annual interest rate (%) , minimum finance charge, and grace period (days) fields. Click the finance charge tab in the left vertical pane, then the company preferences tab in the window that opens. Select the customers and jobs you want to assess finance charges. Select finance charge, then go to the company preferences tab. How to set up finance charges in quickbooks

Source: high5software.com

Source: high5software.com

Make very sure that the assessment. Go to quickbooks company file and login as admin. It costs $270 each month. You’ll see something like this: At times, there is a flat fee for the charge.

Source: financeviewer.blogspot.com

Source: financeviewer.blogspot.com

You’ll see something like this: If desired, edit any of the calculated amounts in the fin. How to set up finance charges in quickbooks 2.4% + 25 cents for swiping a credit card. Give the fee a name.

However, as soon as the customer pays that invoice, quickbooks charges a fee and takes their cut. Fill in the annual interest rate (%) , minimum finance charge, and grace period (days) fields. You can see your finance charge invoices when you go to print them. Tap on the delete tab. At this time, you can exclude the old charges from your record.

Source: financeviewer.blogspot.com

Source: financeviewer.blogspot.com

Your finance charges have now been recorded in quickbooks as individual invoices. If desired, edit any of the calculated amounts in the fin. Click the finance charge tab in the left vertical pane, then the company preferences tab in the window that opens. Go to the edit menu, then select preferences. Finance charges are typically included within a customer’s invoice.

Source: financeviewer.blogspot.com

Source: financeviewer.blogspot.com

How to set up finance charges in quickbooks However, it is the percentage of the borrowing of an extended line of credit most of the time. You’ll see something like this: Tap on the delete tab. Open the edit menu and select preferences.

Source: qbhelp.me

Your finance charges have now been recorded in quickbooks as individual invoices. However, as soon as the customer pays that invoice, quickbooks charges a fee and takes their cut. While the finance charges did access automatically it caused them to loose the attachments linked to the invoice as well as the class they had assigned it to. When it’s time to print, open the file menu and select print forms | invoices. Click the finance charge tab in the left vertical pane, then the company preferences tab in the window that opens.

Source: dummies.com

Source: dummies.com

If desired, edit any of the calculated amounts in the fin. Tap on the delete tab. Navigate to “edit” menu, and make a selection “ preferences.”. Open the edit menu and select preferences. From the category dropdown, and fill out the rest of the fields as desired.

Source: dummies.com

Source: dummies.com

Let me show you how: 2.4% + 25 cents for swiping a credit card. Quickbooks issues an invoice regarding the finance charge, you can print this for your record. You will need to decide on your quickbooks finance charge settings before you can begin to apply these late fees. Select the customers and jobs you want to assess finance charges.

Source: financeviewer.blogspot.com

From the category dropdown, and fill out the rest of the fields as desired. Finance charges are typically included within a customer’s invoice. From the category dropdown, and fill out the rest of the fields as desired. Before you can start adding finance charges to tardy payments, you’ll need to let quickbooks know how you want them handled. You will see your numbered finance charge invoices displayed like this:

Source: quickbooks-training.net

Source: quickbooks-training.net

Navigate to the sales menu and click products and services. It costs $270 each month. Select the customers and jobs you want to assess finance charges. Finance charges are typically included within a customer’s invoice. However, as soon as the customer pays that invoice, quickbooks charges a fee and takes their cut.

Source: financeviewer.blogspot.com

Source: financeviewer.blogspot.com

It costs $270 each month. Your finance charges have now been recorded in quickbooks as individual invoices. If desired, edit any of the calculated amounts in the fin. When it’s time to print, open the file menu and select print forms | invoices. Choose the appropriate a/r account.

Source: quickbooksblog.blogspot.com

There is no agreement included; If they were added into quickbooks, locate each finance charge, then delete them. Significant level bookkeeping ($670 each month) serves organizations with $150,001 or more in month to month costs. You can see your finance charge invoices when you go to print them. From the category dropdown, and fill out the rest of the fields as desired.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how does quickbooks calculate finance charges by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.