Errors of commission and omission

Errors Of Commission And Omission. While both types of errors are common in investing, our goal as shepherds of client capital is to make as few of either as possible. 7 rows error of omission and error of commission. Get professional assignment help cheaply. Incorrect totalling of the subsidiary books.

Russell L Ackoff Quotes & Sayings (16 Quotations) From picturequotes.com

Russell L Ackoff Quotes & Sayings (16 Quotations) From picturequotes.com

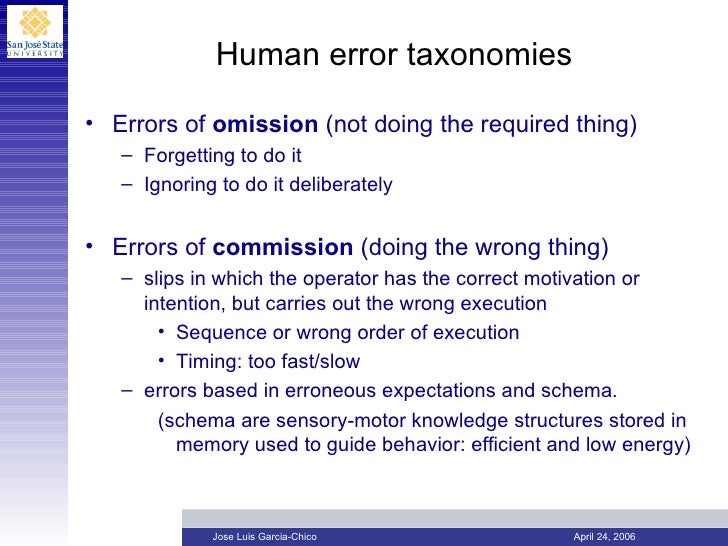

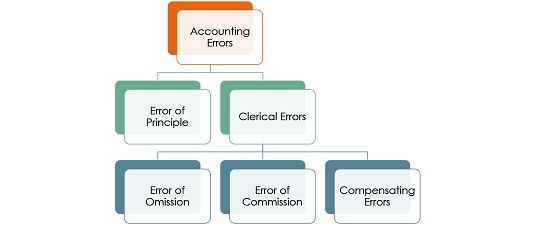

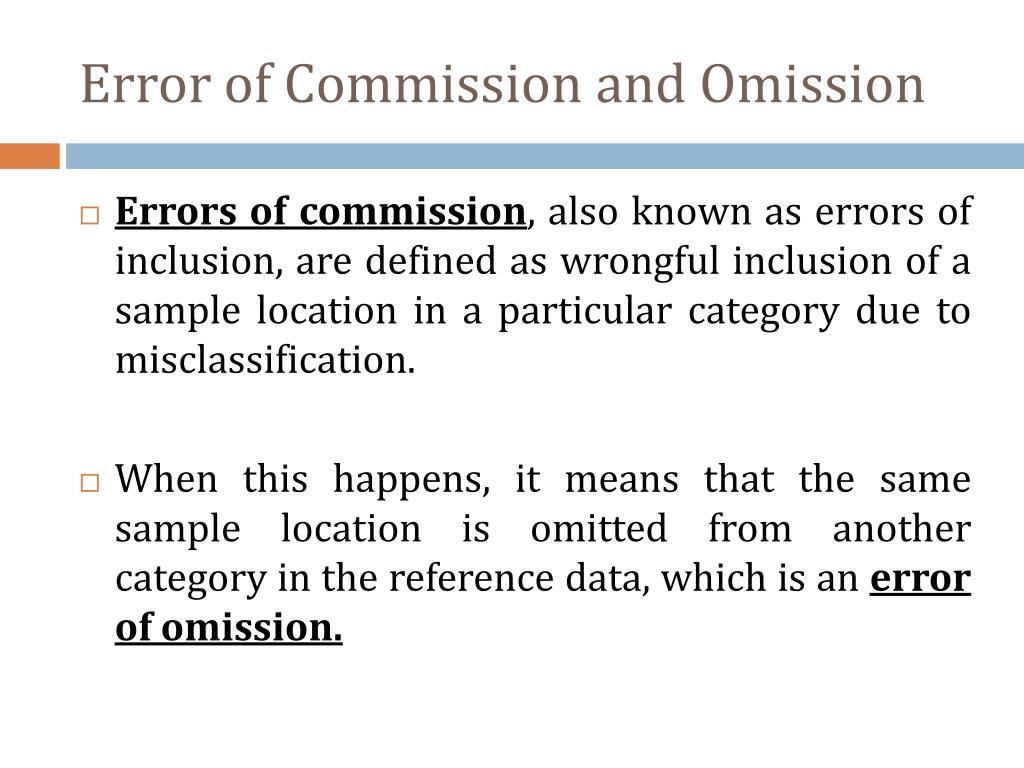

When some transactions are completely omitted from the books of accounts or entered but not posted, they are treated as errors of omission. Errors of commission occur due to the negligence of the accountant or clerk. For this reason, they are often referred to as clerical errors or errors of inadvertence. In contrast to errors of commission, errors of omission are way more difficult to identify. As per double entry system, every debit has its corresponding credit. The accounts will be arithmetically correct only if, there is the same amount at both debit.

The errors of commission are basically errors in arithmetical accuracy.

The accounts will be arithmetically correct only if, there is the same amount at both debit. ⦿ errors of omission ⦿ errors of commission ⦿ errors of principle. The following scenarios can lead to errors of commission: However, you have a zero per cent chance of success if you don’t try, but it’s easier to say you haven’t failed because you didn’t start. On the basis of their impact on ledger accounts ⦿ one sided errors ⦿ two sided errors. Let’s consider a few examples to show how errors of commission are caused:.

Source: researchgate.net

Source: researchgate.net

Let’s consider a few examples to show how errors of commission are caused:. If a transaction is omitted altogether from the books of accounts, there would be neither a debit nor a credit entry in the ledger. As per double entry system, every debit has its corresponding credit. He doesn’t record both debit and credit aspects of the transaction and therefore it doesn’t impact the trail balance.for example, goods sold on credit to the customer, but not recorded in the sales book. In the former, an entry or part of entry is not recorded at all whereas in the latter, entries are recorded but erroneously.

Source: researchgate.net

Source: researchgate.net

Refers to any act of commission or omission by the individual in contact with the patient that leads or may lead to an undesirable outcome. In general, managers worry more about doing the wrong thing than they do about failing to do the right thing, even if the latter is just as important. Hence, the trial balance will not be affected. The errors of commission are basically errors in arithmetical accuracy. ⦿ the accountant fully omits the transaction i.e.

Source: slideshare.net

Source: slideshare.net

In the former, an entry or part of entry is not recorded at all whereas in the latter, entries are recorded but erroneously. Refers to any act of commission or omission by the individual in contact with the patient that leads or may lead to an undesirable outcome. While both types of errors are common in investing, our goal as shepherds of client capital is to make as few of either as possible. Hence, the trial balance will not be affected. Both errors of omission and errors of commission are clerical arithmetic errors.

Source: researchgate.net

Source: researchgate.net

For this reason, they are often referred to as clerical errors or errors of inadvertence. Are you busy and do not have time to handle your assignment? Are you scared that your paper will not make the grade? In fact, any instance in which a doctor, nurse, or other healthcare team member fails to use their training to adequately treat a patient could rise to the level of medical malpractice. When some transactions are completely omitted from the books of accounts or entered but not posted, they are treated as errors of omission.

Source: keydifferences.com

Source: keydifferences.com

For this reason, they are often referred to as clerical errors or errors of inadvertence. For this reason, they are often referred to as clerical errors or errors of inadvertence. Refers to any act of commission or omission by the individual in contact with the patient that leads or may lead to an undesirable outcome. Errors of omission and commission. The accounts will be arithmetically correct only if, there is the same amount at both debit.

Source: reddit.com

Source: reddit.com

⦿ the accountant fully omits the transaction i.e. Both errors of omission and errors of commission are clerical arithmetic errors. In fact, any instance in which a doctor, nurse, or other healthcare team member fails to use their training to adequately treat a patient could rise to the level of medical malpractice. ⦿ the accountant fully omits the transaction i.e. Are you busy and do not have time to handle your assignment?

Source: paulsnewsline.blogspot.com

Source: paulsnewsline.blogspot.com

As per double entry system, every debit has its corresponding credit. The accountant’s main function is to record transactions of the business immediately after the transaction takes place, but sometimes the accountant forgets. (ismp) proposes a series of basic recommendations to prevent errors by omission or delay in the administration of medications, which implies a review of the entire medication management process in the. Errors of omission mean you’re missing the upside (the forecasted value increase in the price of an investment), whereas errors of commission affect the downside (risk protection) and they prevent excellence. Both errors of omission and errors of commission are clerical arithmetic errors.

Source: azquotes.com

Source: azquotes.com

Are you busy and do not have time to handle your assignment? Are you scared that your paper will not make the grade? Again in errors of omission is classified into two types, they are: Get professional assignment help cheaply. The accountant’s main function is to record transactions of the business immediately after the transaction takes place, but sometimes the accountant forgets.

Source: researchgate.net

Source: researchgate.net

Are you scared that your paper will not make the grade? ⦿ the accountant fully omits the transaction i.e. In general, managers worry more about doing the wrong thing than they do about failing to do the right thing, even if the latter is just as important. Let’s consider a few examples to show how errors of commission are caused:. 7 rows errors of omission occur due to mistakes on the part of the accountant in recording the.

Source: researchgate.net

Source: researchgate.net

Ackoff starts by exploring the hierarchy of mental content, which he orders as. For this reason, they are often referred to as clerical errors or errors of inadvertence. Both errors of omission and errors of commission are clerical arithmetic errors. That’s why we have developed 5 beneficial guarantees that will make your experience with our service enjoyable, easy, and safe. In the former, an entry or part of entry is not recorded at all whereas in the latter, entries are recorded but erroneously.

Source: researchgate.net

Source: researchgate.net

Even though accountants put in their best effort. Both errors of omission and errors of commission are clerical arithmetic errors. ⦿ the accountant fully omits the transaction i.e. As per double entry system, every debit has its corresponding credit. ⦿ errors of omission ⦿ errors of commission ⦿ errors of principle.

Source: researchgate.net

Source: researchgate.net

Let’s consider a few examples to show how errors of commission are caused:. The following scenarios can lead to errors of commission: ⦿ the accountant fully omits the transaction i.e. While both types of errors are common in investing, our goal as shepherds of client capital is to make as few of either as possible. Are you scared that your paper will not make the grade?

Source: researchgate.net

Source: researchgate.net

That’s why we have developed 5 beneficial guarantees that will make your experience with our service enjoyable, easy, and safe. Posting the correct amount in the. The errors of commission are basically errors in arithmetical accuracy. Again in errors of omission is classified into two types, they are: Both medical errors of commission and omission would constitute medical malpractice.

Source: emcrit.org

Source: emcrit.org

The following scenarios can lead to errors of commission: Let’s consider a few examples to show how errors of commission are caused:. For this reason, they are often referred to as clerical errors or errors of inadvertence. While both types of errors are common in investing, our goal as shepherds of client capital is to make as few of either as possible. Posting the correct amount in the.

Source: picturequotes.com

Source: picturequotes.com

Recording of wrong amount in the correct subsidiary books. The following scenarios can lead to errors of commission: In the former, an entry or part of entry is not recorded at all whereas in the latter, entries are recorded but erroneously. Errors come in two different categories: In general, managers worry more about doing the wrong thing than they do about failing to do the right thing, even if the latter is just as important.

Source: researchgate.net

Source: researchgate.net

In the former, an entry or part of entry is not recorded at all whereas in the latter, entries are recorded but erroneously. (1) doing a wrong thing and (2) failing to do the right thing. Even though accountants put in their best effort. When some transactions are completely omitted from the books of accounts or entered but not posted, they are treated as errors of omission. Several of these errors can be identified through periodic reconciliations, including third party balance reconciliations, bank.

Source: researchgate.net

Source: researchgate.net

On the basis of their impact on ledger accounts ⦿ one sided errors ⦿ two sided errors. 7 rows error of omission and error of commission. Errors of commission occur due to the negligence of the accountant or clerk. Errors of omission mean you’re missing the upside (the forecasted value increase in the price of an investment), whereas errors of commission affect the downside (risk protection) and they prevent excellence. The errors of commission are basically errors in arithmetical accuracy.

Source: slideserve.com

Source: slideserve.com

In the former, an entry or part of entry is not recorded at all whereas in the latter, entries are recorded but erroneously. The following scenarios can lead to errors of commission: ⦿ the accountant fully omits the transaction i.e. If a transaction is omitted altogether from the books of accounts, there would be neither a debit nor a credit entry in the ledger. Entering the wrong amount in the correct subsidiary book;

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title errors of commission and omission by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.