Current liabilities and payroll accounting

Current Liabilities And Payroll Accounting. In order for an employer to accrue liability for employee�s compensation for future absences, several conditions must be met. Overview of current liabilities and payroll. Current liabilities and payroll accounting after studying this chapter, you should be able to: Current liabilities and payroll accounting;

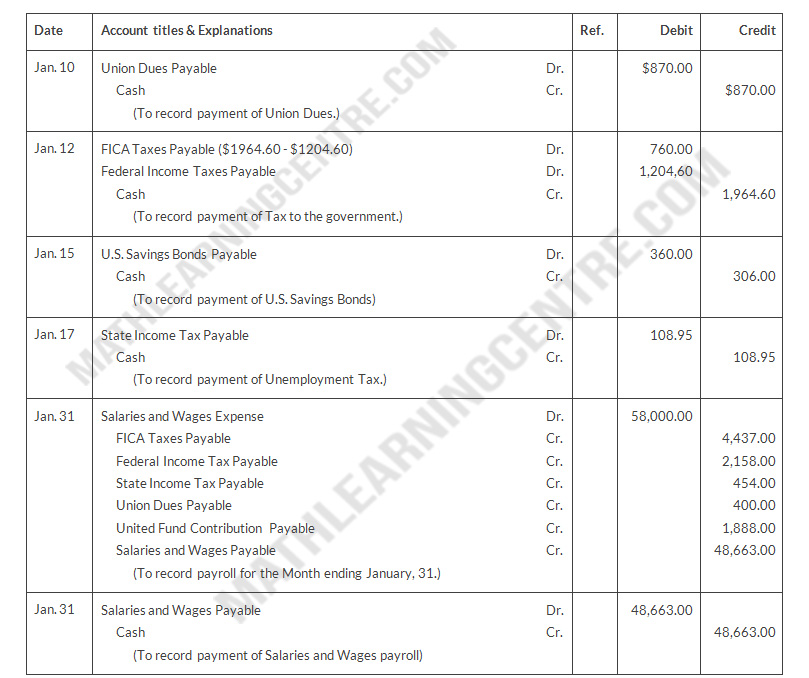

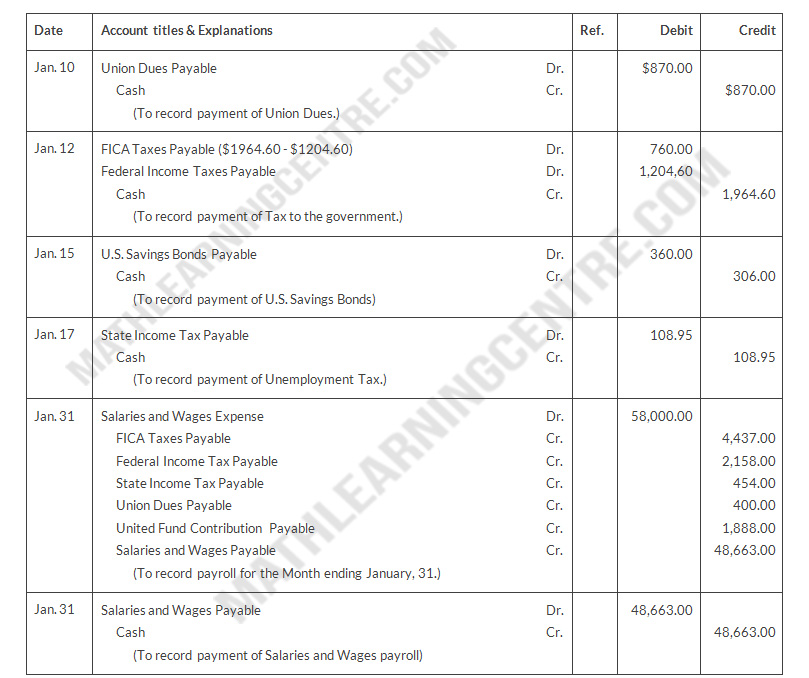

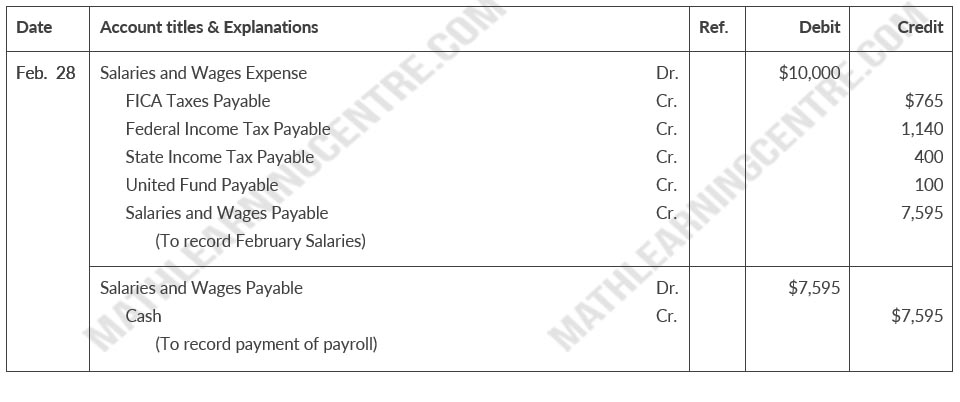

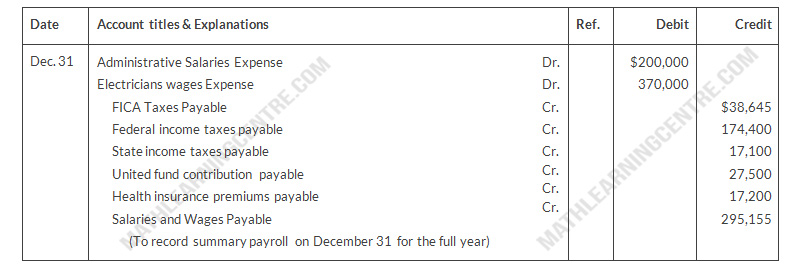

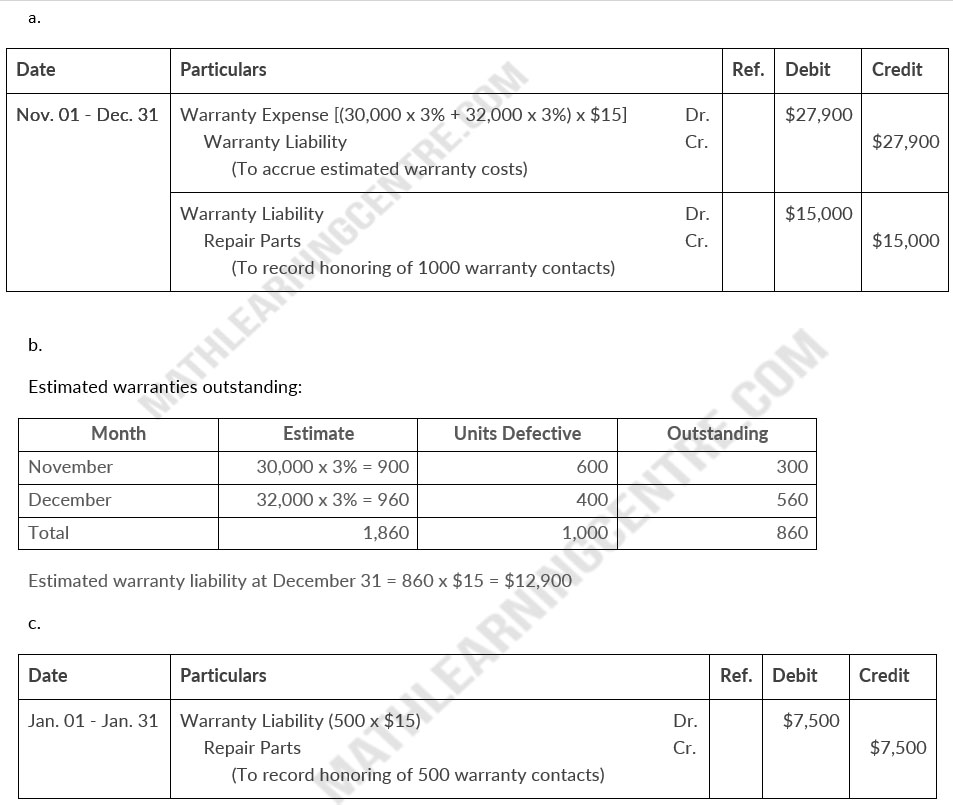

Problem04 Current Liabilities and Payroll Accounting From mathlearningcentre.com

Problem04 Current Liabilities and Payroll Accounting From mathlearningcentre.com

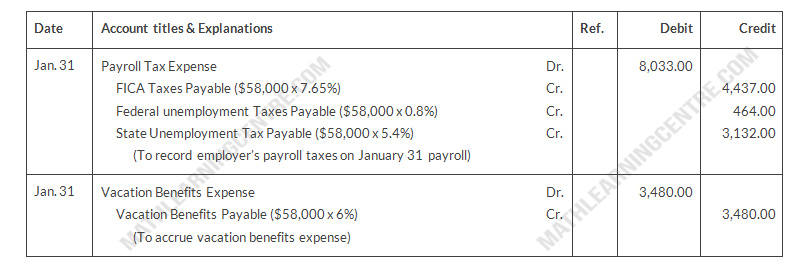

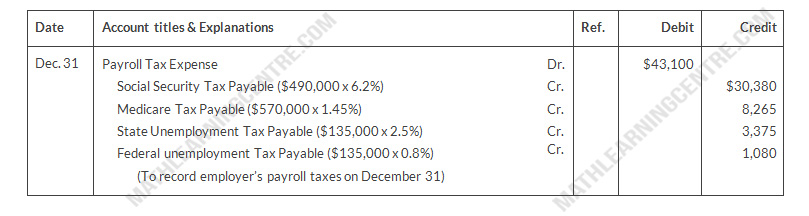

Company expects to pay the debt from existing. Notes payable 100,000 interest expense* 875 cash 100,875 b. 44 recognizing payroll expenses and liabilities academy company records its payroll for the week ending january 14, 2005 with the journal entry above. Payroll tax expense 810 employer payroll taxes payable 810 d. Payroll accounting (accountingtools) payroll liabilities (cliff�s notes) payroll liabilities vs. It is shown as accrued liabilities or payables in the records of accounting.

Liabilities are reflected in the accounting records as payables or accrued liabilities.

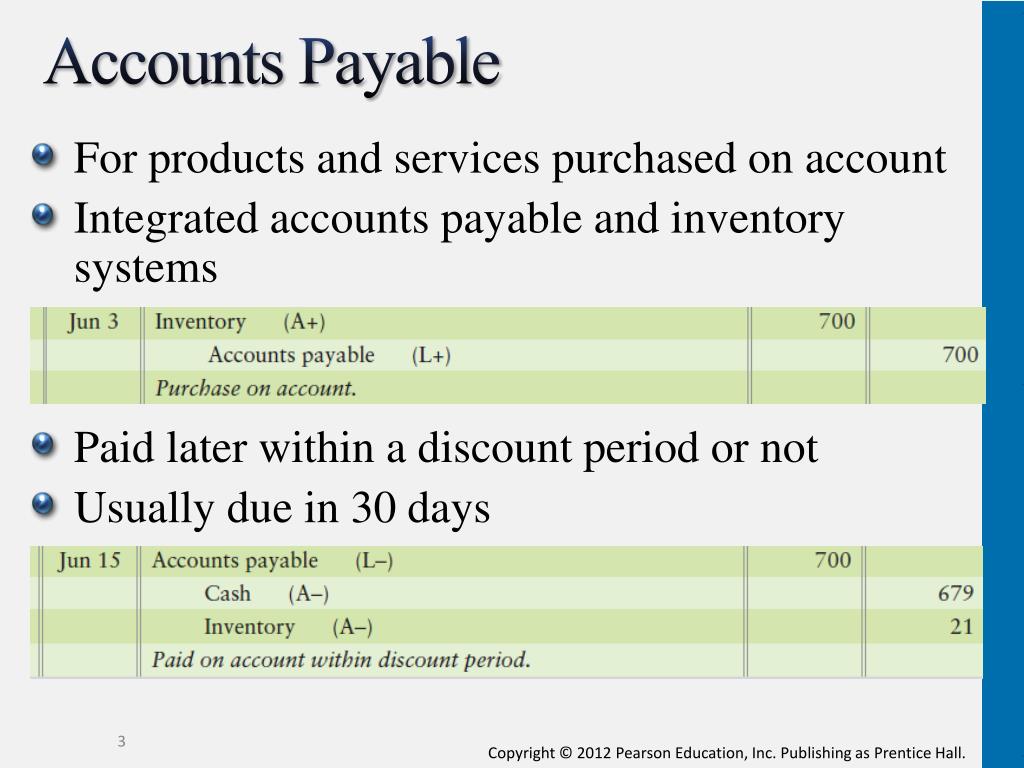

The current portion of notes payab le is the principal amount that will be paid within one. Recording payroll and payroll liabilities; Explain a current liability, and identify the major types of current liabilities. Examples of current liabilities include accounts payables. It also arises when trades owe wages and salaries to workers that will not be paid until the. Accounts payable 100,000 notes payable 100,000 2.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

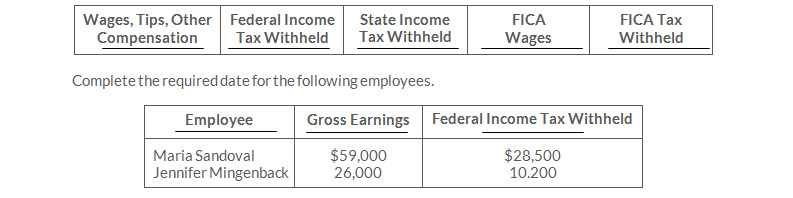

Amounts withheld from worker pay for income taxes must be forwarded to the. Current liabilities and payroll accounting When a payment of $1 million is made, the company�s accountant makes a $1 million debit entry to the other current liabilities account and a $1 million credit to the cash account. When you manage payroll, your company incurs two types of payroll obligations: The operating cycle, whichever is longer.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

Accounts payable 100,000 notes payable 100,000 2. In order for an employer to accrue liability for employee�s compensation for future absences, several conditions must be met. Reporting of current liabilities current liabilities are the first category under liabilities on the balance sheet. Current liabilities and payroll accounting The learning objectives for this chapter are to 1.

Source: redwingsoftware.com

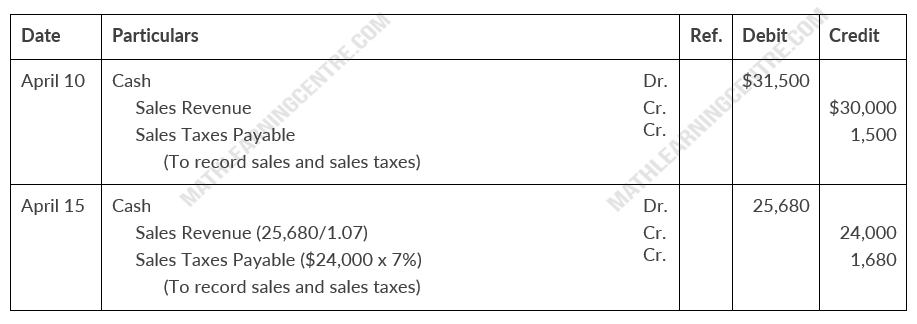

The march 25 cash register reading for cooley grocery shows sales of $10,000 and sales taxes of $600 (sales tax rate of 6%), the journal entry is: Account for current liabilities that must be estimated. When you manage payroll, your company incurs two types of payroll obligations: Recording payroll and payroll liabilities; For instance, assume a company signed a series of 10 individual notes.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

Current assets or through the creation of other current liabilities. In accounting, a liability is an obligation to pay an amount. It also arises when trades owe wages and salaries to workers that will not be paid until the. Company will pay the debt within one year or Explain a current liability, and identify the major types of current liabilities.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

Recognizing the pretentiousness ways to get this books current liabilities and payroll accounting homework answers is additionally useful. Accounts payable 100,000 notes payable 100,000 2. Accounting equation and examine liabilities, specifically current liabilities and payroll. The learning objectives for this chapter are to 1. Current assets or through the creation of other current liabilities.

Source: studylib.net

Source: studylib.net

The current portion of notes payab le is the principal amount that will be paid within one. Accounts payable 100,000 notes payable 100,000 2. Current liabilities and payroll accounting after studying this chapter, you should be able to: Company expects to pay the debt from existing current assets or. Explain a current liability, and identify the major types of current liabilities.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

In relation to compensated absences, the knowledge of the conditions that must be met in order to accrue loss contingency is helpful in accounting for compensated absences such as vacation, sick pay, and leave. Company will pay the debt within one year or Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Chapter 11 current liabilities and payroll ex. Examples of current liabilities include accounts payables.

![Ch11 Current Liabilities and Payroll Accounting [PPT Powerpoint] Ch11 Current Liabilities and Payroll Accounting [PPT Powerpoint]](https://reader018.vdocuments.mx/reader018/slide/20191101/544c48e7b1af9f767d8b4e6b/document-42.png?t=1628864880) Source: vdocuments.mx

Source: vdocuments.mx

Describe the accounting for notes payable. Payroll accounting (accountingtools) payroll liabilities (cliff�s notes) payroll liabilities vs. Amounts withheld from worker pay for income taxes must be forwarded to the. Accounting equation and examine liabilities, specifically current liabilities and payroll. Current liabilities and payroll accounting;

Current liabilities of a business are those that need to be paid during the operating cycle or within a year, whichever is longer. Describe the accounting for notes payable. Reporting of current liabilities current liabilities are the first category under liabilities on the balance sheet. Current liabilities and payroll accounting after studying this chapter, you should be able to: In order for an employer to accrue liability for employee�s compensation for future absences, several conditions must be met.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

In addition, companies disclose the terms of notes payable and other key information about the individual items in the notes to the financial statements. Current liabilities and payroll accounting When a payment of $1 million is made, the company�s accountant makes a $1 million debit entry to the other current liabilities account and a $1 million credit to the cash account. Company expects to pay the debt from existing. Salary expense 4,900 salary payable 4,900 c.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

It is shown as accrued liabilities or payables in the records of accounting. The operating cycle, whichever is longer. Account for current liabilities of known amount. Explain the accounting for other current liabilities. Explain a current liability, and identify the major types of current liabilities.

![Ch11 Current Liabilities and Payroll Accounting [PPT Powerpoint] Ch11 Current Liabilities and Payroll Accounting [PPT Powerpoint]](https://reader018.vdocuments.mx/reader018/slide/20191101/544c48e7b1af9f767d8b4e6b/document-19.png?t=1628864880) Source: vdocuments.mx

Source: vdocuments.mx

So 3 explain the accounting for other current liabilities. Payroll accounting (accountingtools) payroll liabilities (cliff�s notes) payroll liabilities vs. Company expects to pay the debt from existing current assets or. Each of the principal types of current liabilities is listed separately. Current liabilities of a business are those that need to be paid during the operating cycle or within a year, whichever is longer.

Source: youtube.com

Source: youtube.com

Current liabilities and payroll accounting; Notes payable 100,000 interest expense* 875 cash 100,875 b. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Accounting equation and examine liabilities, specifically current liabilities and payroll. The current portion of notes payab le is the principal amount that will be paid within one.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

When a payment of $1 million is made, the company�s accountant makes a $1 million debit entry to the other current liabilities account and a $1 million credit to the cash account. In relation to compensated absences, the knowledge of the conditions that must be met in order to accrue loss contingency is helpful in accounting for compensated absences such as vacation, sick pay, and leave. Company expects to pay the debt from existing current assets or. Account for current liabilities that must be estimated. Salary expense 4,900 salary payable 4,900 c.

![Ch11 Current Liabilities and Payroll Accounting [PPT Powerpoint] Ch11 Current Liabilities and Payroll Accounting [PPT Powerpoint]](https://reader018.fdocuments.in/reader018/slide/20191101/544c48e7b1af9f767d8b4e6b/document-11.png?t=1617533418) Source: fdocuments.in

Source: fdocuments.in

Office salaries expense ($5,200) and wages payable ($12,010) are debited in total for $17,210 in gross earnings. For instance, assume a company signed a series of 10 individual notes. Recognizing the pretentiousness ways to get this books current liabilities and payroll accounting homework answers is additionally useful. In accounting, a liability is an obligation to pay an amount. The march 25 cash register reading for cooley grocery shows sales of $10,000 and sales taxes of $600 (sales tax rate of 6%), the journal entry is:

Source: slideserve.com

Source: slideserve.com

Current liabilities and payroll accounting 11 chapter 11 current liabilities and payroll review questions liabilities are liabilities that do not need to be paid within one year or within. The operating cycle, whichever is longer. The learning objectives for this chapter are to 1. When a payment of $1 million is made, the company�s accountant makes a $1 million debit entry to the other current liabilities account and a $1 million credit to the cash account.

Source: mathlearningcentre.com

Source: mathlearningcentre.com

Current liabilities and payroll accounting after studying this chapter, you should be able to: Company expects to pay the debt from existing. Company will pay the debt within one year or Explain a current liability, and identify the major types of current liabilities. Chapter 11 current liabilities and payroll ex.

![Ch11 Current Liabilities and Payroll Accounting [PPT Powerpoint] Ch11 Current Liabilities and Payroll Accounting [PPT Powerpoint]](https://reader018.fdocuments.in/reader018/slide/20191101/544c48e7b1af9f767d8b4e6b/document-12.png?t=1617533418) Source: fdocuments.in

Source: fdocuments.in

Internal control for payroll accounting for current liabilities current liability is debt with two key features: The learning objectives for this chapter are to 1. You have remained in right site to start getting this info. Account for current liabilities of known amount. Accounts payable 100,000 notes payable 100,000 2.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title current liabilities and payroll accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.